War between Israel and Hamas carries the risk of a renewed rise in energy prices, especially for Europe. Better-than-expected economic growth in the third quarter, particularly in the US and China. Outlook remains cautious: tight monetary policy leaving its mark, high government debt back in focus.

Chart of the month

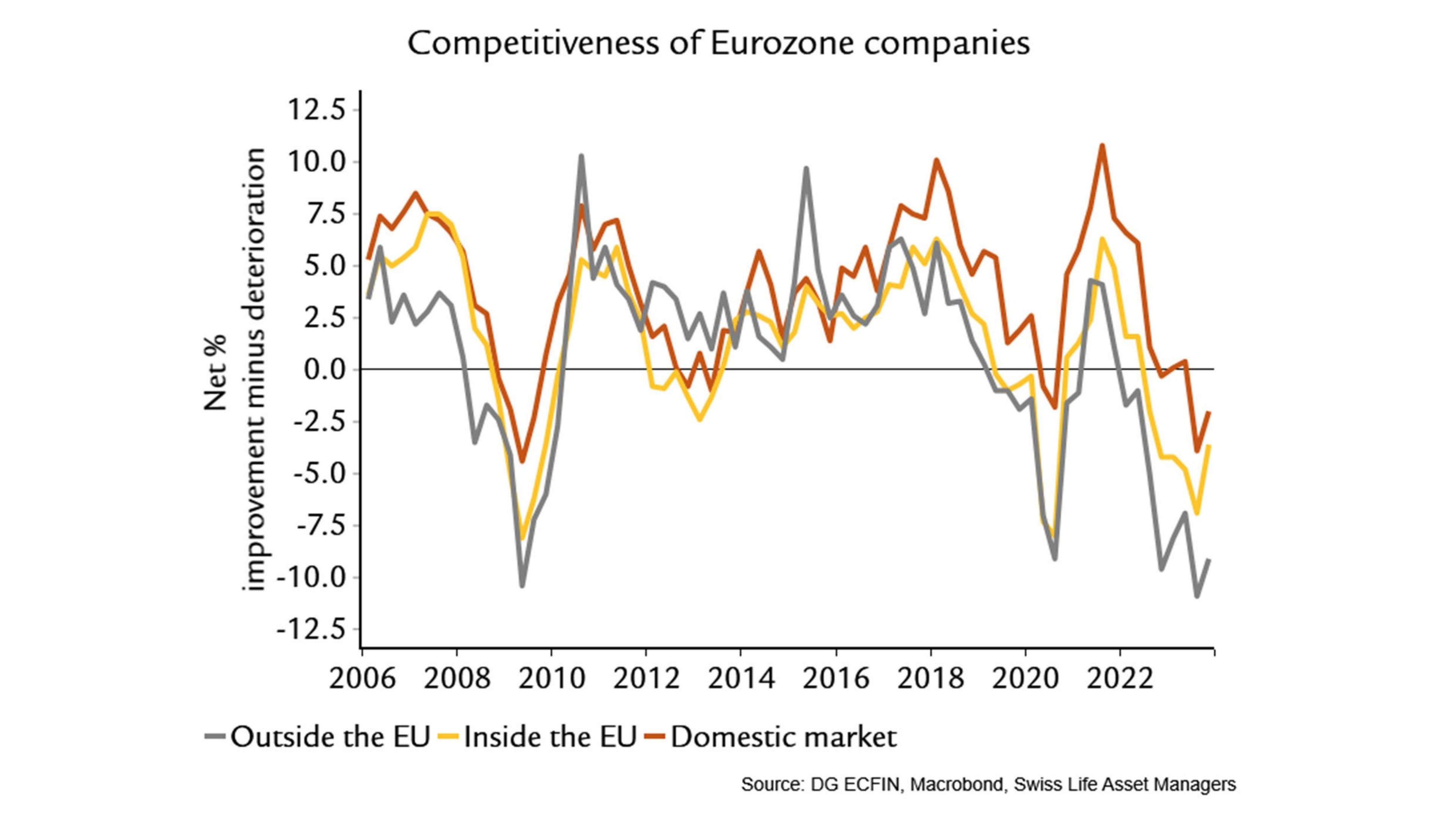

More and more companies in the Eurozone have been reporting a deterioration in their competitiveness since 2022. This is particularly noticeable on markets outside the EU, especially for German companies. One driver is likely to be the ongoing high energy prices. The competitiveness of energy-intensive industries such as chemicals, metal and paper production is particularly low. Pharmaceutical companies and car manufacturers are also complaining about increasing competition, the latter particularly due to electric cars from China. The EU has therefore recently launched an anti-subsidy investigation into imports of Chinese electric cars.